Watkins Multi-Channel Strategy

Sales Report

By Watkins Platinum Executive Steve Bretzke

November 8, 2013

Watkins products have been sold through retail outlets in various forms for more than 100 years. But, in the early 2000s, the company took additional steps to make "Watkins" more of a household name. One of the things they did was to increase the presence of Watkins products in national and regional chains where most families routinely shop.

Most of the expansion into national chains has taken place since 2008, with the goal of widening distribution, introducing the brand to those unfamiliar with it, increasing manufacturing efficiencies, and increasing profitability. The strategy was designed to also benefit Independent Consultants by creating increased demand, lowering prices, and developing a wider and more current product selection.

Since this was a new approach, many of our Timeless Integrity team members questioned this strategy. No other direct selling / network marketing company had successfully gone down this road, and many of our team perceived the other channels to simply be increased competition.

As a former engineer, I knew that nothing would answer this question better than a thorough analysis of the data. So I checked to see if Watkins could provide me with some historical sales data. They were able to provide me with complete sales data for every product purchased by Independent Consultants in Timeless Integrity from January through June of 2007 and from January through June of 2012. Having this data would allow me to analyze the change in sales trends during this five year period, and specifically try to reach some conclusions to determine the impact of Watkins Multi-Channel strategy.

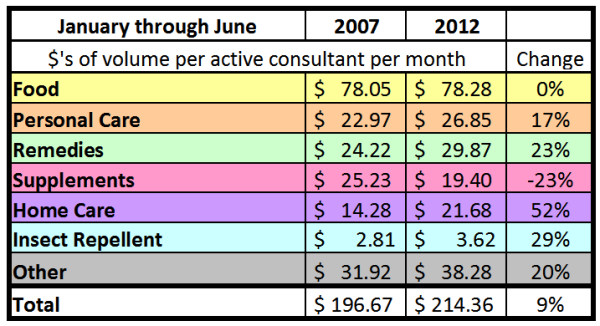

This report was written to break down the data by product category over this five year period. I looked at the average sales per active consultant, in order to equalize the two time frames. An active consultant was defined as anyone who had more than zero volume in a given month. I did not take into account inflation, because there weren't that many price increases in those five years, and also there were quite a few price decreases to counteract them. Here are the overall results:

As you can see, the average sales per active consultant in all categories was positive, except for the Dietary Supplement category. But even that category is promising once you dig down a little deeper which I will do a little bit later in this report.

The bottom line to these results is this:

- Despite a poor economy and challenging economic times, sales were up, when the numbers were equalized based on the number of active consultants.

- Despite tremendous perceived challenges with select Watkins products being available through Walmart, Target, internet discounters, and an ever increasing general retail presence of these products, the sales by consultants had increased!

So, let's dig down deeper into the numbers.

Food Category

In 2007, Watkins had more products in the food category, with a total of 260 different items. There were two complete lines of spices, the all-natural and the newly introduced organic spices, as well as a larger number of spice blends. Over those five years, consolidation took place and some slow sellers were discontinued, leaving us with 146 different items in this category in 2012. Even with this reduction in available food products, the overall food line sales did not decline from 2007 to 2012.

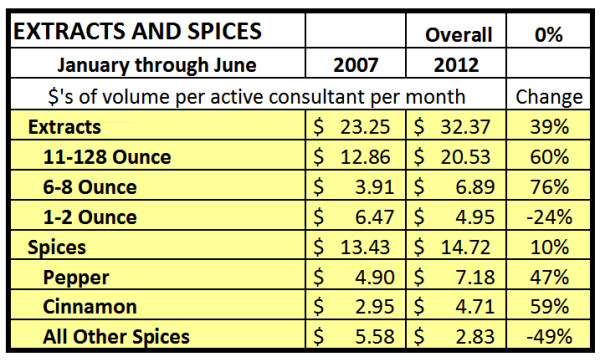

A more interesting analysis involves the extracts. In 2007, Watkins had a bunch of 2-ounce extracts, a handful of 6-ounce extracts and the 11-ounce and gallon vanilla sizes. Walmart has had several 2-ounce vanilla extracts on their shelves for many years, and now since 2010, most Walmarts have had the entire line of 2-ounce extracts as well. In 2011, Watkins introduced the full line of 8-ounce extracts to the home business field, but those have now been discontinued, with the best sellers moving to an 11-ounce economy size. So how did the various extract sales compare? See the chart below:

As you can see, extract sales in 2012 were up 39% over 2007. 11-ounce vanilla sales were up 60%. The economy size 8-ounce extracts were 76% higher than the 6-ounce size extracts that were available in 2007. Only the 2-ounce extracts had lower sales, down 24%, but remember, every extract was available in 2012 in both a 2-ounce and an 8-ounce size. The huge 39% increase in overall extract sales is a solid indicator that Watkins Multi-Channel strategy is working, and we know this will be a relief to those consultants who mistakenly thought this would hurt their sales.

How about spices? You may not realize that Watkins is much more of a Cinnamon and Pepper company than an overall spice company. The total sales of Black Pepper and Cinnamon far outsell the total sales of all the other spices combined! In 2008 and 2009, many Walmarts carried the full line of Watkins all-natural spices in tins, and resulting numbers show Independent Consultant's Black Pepper sales were up 47% and Cinnamon sales were up 59%! The rest of the spice line decreased 49%, but much of this was due to the elimination of the organic line of spices.

Overall spice sales were up 10% from 2007 through 2012, and even if the entire line of 52 spices were placed in every Walmart, there is no question that incremental sales growth (and profits!) in the food category will continue to be seen in the coming years.

Personal Care Category

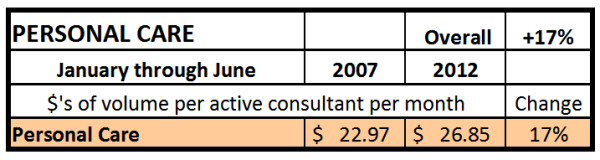

Watkins has never really been known as a personal care company. Sure, we've had various lotions, salves, and skin care, but with a few exceptions, it's been a challenge for Watkins to find the right products that sold well enough to justify the development and manufacturing along with the catalog space. In 2007, Watkins developed the "Apothecary" line of body lotions, shea butters, and dry oil products not only for the Independent Consultants, but also for placement in limited distribution in Walmart and Target stores. This multi-channel development approach gave us more products and created manufacturing efficiencies that we've never had before. For the past five years, this line has continued to evolve and develop, with many of the products in the personal care category making their way into various retail store distribution.

Independent Consultants can be thankful for this approach, as today the line has become a strong profit center, with 2012 sales up 17% over 2007. We can look forward to continued product development (and higher profits) in this area.

Remedies Category

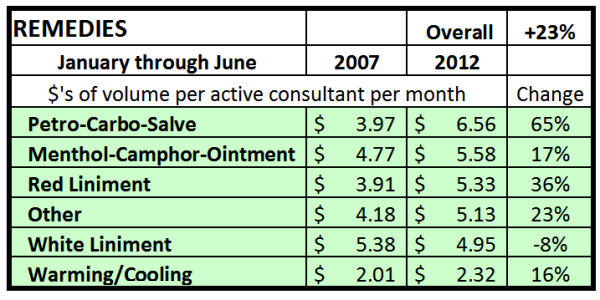

Sales in the Remedies category overall were up 23% from 2007 to 2012. This is interesting because some of the liniments and salves that are top sellers for Independent Consultants have crept into some retail brick and mortar stores and online retailers over the past few years. Without sales data, a consultant might be concerned about this. But, again, the multi-channel approach to distribution has led to across the board increases!

Petro Carbo Salve sales were up 65%. Menthol Camphor Ointment sales were up 17%. Red Liniment Sales were up 36%. The Warming Balm / Cooling Gel sales were up 16%. Only the White Liniment sales were down, and only by 8%. Again, the bottom line is that sales were up big and the multi-channel strategy by Watkins can take at least part of the credit.

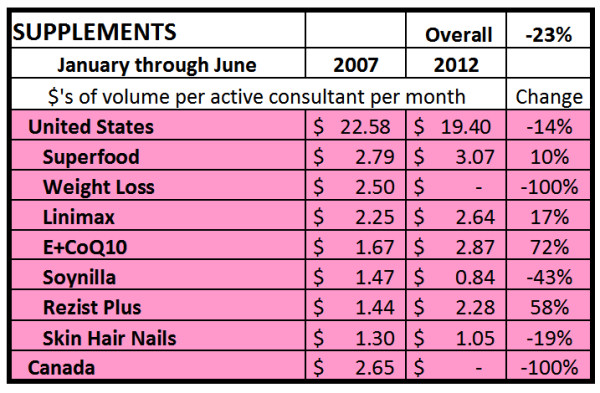

Supplements Category

While none of the Dietary Supplements have been in retail stores, it is interesting to see the sales strength in these products, even years after they were first introduced. And even though the category has seen a 23% decrease overall, this can be fully attributed to sales being stopped in Canada, and the discontinuing of the weight loss products.

As you can see, Superfood sales were up, Linimax sales were up, E+CoQ10 and Rezist Plus sales were up. There is no question that Dietary Supplements are an important part of our business, and they are even more essential with those building a personal use / network marketing business. With the launch of a new line of supplements in both the United States and Canada, there is a ton of potential here!

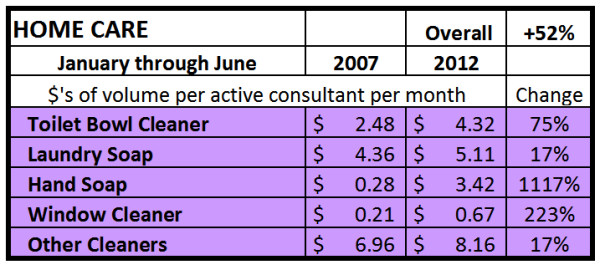

Home Care Category

This is a fun one because the data gives a before and after snapshot with the current line of all natural cleaners. How about a 52% increase? We'll take it every day! And that increase comes along with knowing that a handful of these cleaners are in most Target stores and priced aggressively.

Every category of cleaning products showed increases, even window cleaner was up 223%. And before the foaming hand cleansers were introduced, the regular hand soaps had given us a 1117% increase! Toilet bowl cleaner was up 75%, and although I have no idea why every consultant isn't using at least one of Watkins laundry detergents, even those sales were up 17%. Cleaners were also a challenging category for Watkins to develop and manufacture, and this is another example of a product line that likely could not have been introduced without the support of the retail channel. It now has a major impact on home business consultant profitability.

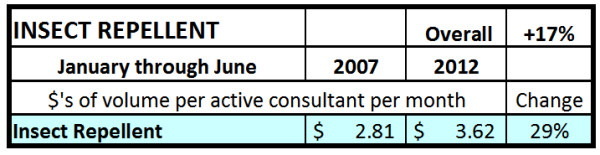

Insect Repellent Category

I separated this out since these products are only in Canada, but it again is exciting to see this category grow by 29% while knowing that Watkins has some of these products in retail outlets in Canada.

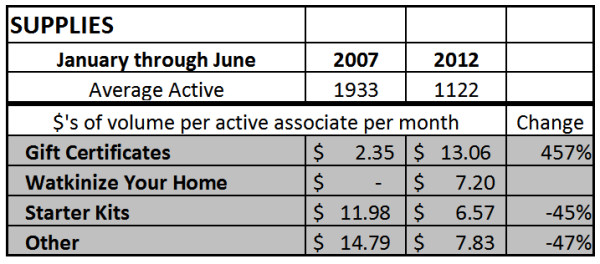

Supplies Category

While this area is not affected by the multi-channel approach, I've looked at the data because it shows the impact of the Watkinize Your Home program.

The numbers show that more people were utilizing Gift Certificates, and that people were purchasing less and less paper from Watkins, which is likely due to the increased use of the Internet. Starter kit volume was down which was partly due to lower sponsoring, but also because there were some higher priced upgrades in 2007 that were not available in 2012.

The Watkinize Your Home assortment also has likely had an affect on the various sales levels for 2012, since the assortment is made up of many products from the different categories. However, there is no way to easily show this in the category charts. What this really means is that the sales gains shown in the first part of this report would actually be greater, had the WYH assortment not been available in 2012.

Conclusions

So what does the data say about the impact of Watkins Multi-Channel strategy?

So what does the data say about the impact of Watkins Multi-Channel strategy?

Some consultants wrongly assumed that having products in retail stores would automatically hurt us. Some incorrectly assumed that having products in retail stores would take sales away from consultants. But the exact opposite has happened. Having products in retail stores has taken sales away from Proctor & Gamble, and McCormick, NOT from Watkins consultants. And having this increased brand awareness has led to many new customers for consultants, and many new people being sponsored.

We certainly recognize that this incorrect assumption has likely affected the retention rate, with some people not renewing due to this Multi-Channel strategy implemented by Watkins. In a similar way, it probably affected sponsoring, due to some people being concerned about what this meant for the future. And it also may have affected existing consultants, who might have had their confidence shaken, or were worried as to whether this was the right business path for them to be on.

All those concerns were, to some extent, valid. The lack of confidence was, for the most part, understandable. The fear of what the future may hold was somewhat justified...

But only because there was no track record to look at.

Those days are now over. Even with the fear, the concerns, and the lack of confidence, some people soldiered on. Some people believed and trusted Watkins when they said that they were going to launch a strategy that no company had ever employed before. And they believed Watkins when they said it would make the company stronger, but also make the consultant more money.

This has now proved itself to be true. The numbers don't lie.

The numbers show an overall sales increase per active consultant of 9%, and tremendous increases in many product categories, like extracts +39%, remedies +23%, and home care +52%!

What does the future hold? Since this data was compiled, Watkins has now added a new line of foaming hand soaps, a new dietary supplement line for both the U.S. and Canada, and a new line of 52 spices in the U.S.

Over the past five years, even with some consultants questioning the validity of Watkins Multi-Channel strategy, overall sales per active consultant increased.

Just imagine what will happen in the next five years, now that YOU know with certainty that you and your team will benefit from Watkins' revolutionary Multi-Channel approach!

The future looks bright indeed!

Read the Next Article: Pricing Concerns related to Watkins Multi-Channel Strategy

|